Company depreciation calculator

Depreciation Calculator This depreciation calculator is for calculating the depreciation schedule of an asset. MACRS Depreciation Formula The MACRS Depreciation Calculator uses the following basic formula.

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculator is available for Windows.

. After two years your cars value. It provides a couple different methods of depreciation. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures.

First one can choose the. Our car depreciation calculator uses the following values source. Gas repairs oil insurance registration and of course.

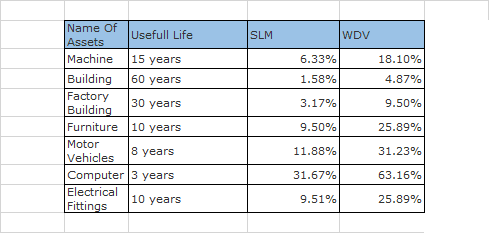

You can calculate depreciation using any depreciation method. Asset-based depreciation calculate your share of deprecating assets in a partnership calculate the decline in value on multiple assets compare depreciation amounts between the prime cost and. Depreciation formula The Car Depreciation.

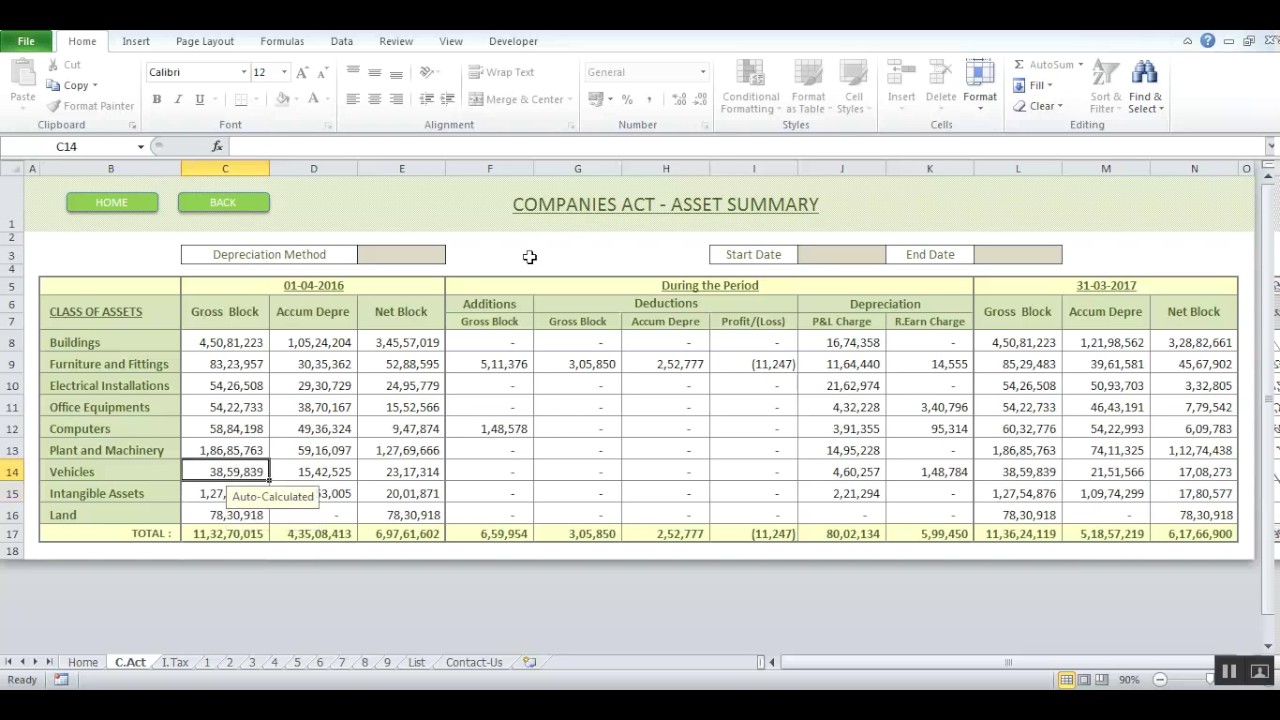

TaxAdda Private Limited CIN - U93000RJ2019PTC067547 GSTIN - 08AAHCT6764E1Z1. Depreciation Calculator as per Companies Act 2013. D i C R i Where Di is the depreciation in year i C is the original purchase price or.

A car that doesnt depreciate as much will save you more money than one that costs a little less to fill up and lasts longer between refuels. Rental property depreciation calculator. There are many variables which can affect an items life expectancy that should be taken.

Business vehicle depreciation calculator. Every business needs assets to generate revenue and most assets require business owners to post depreciation. Depreciation Calculators Instructions To use this calculator first enter the cost price of the fixed asset then enter the number of years you are planning to use the asset over.

Depreciation calculator companies act. Straight Line Asset Depreciation Calculator Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of depreciation of. However different cars depreciate at different rates with SUVs and trucks generally.

After a year your cars value decreases to 81 of the initial value. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and. Depreciation limits on business vehicles.

Audience Fixed Asset Management solution for companies About Depreciation Calculator Our software was designed and written with the. The ABCAUS Depreciation calculator for FY 2021-22 has also been. According to a 2019 study the average new car depreciates by nearly half of its value after five years.

The maiden ABCAUS Excel Companies Act 2013 Depreciation Calculator was first launched in March 2015. Use this discussion to understand how to calculate depreciation and the. Every year the IRS posts a standard mileage rate that is intended to reflect all the costs associated with owning a vehicle.

Depreciation Calculator Depreciation Calculator The calculator should be used as a general guide only. Current year depreciation value asset cost salvage value units produced in useful life How can I calculate depreciation. Non-ACRS Rules Introduces Basic Concepts of Depreciation.

Depreciation Formula Calculate Depreciation Expense

1 Free Straight Line Depreciation Calculator Embroker

Macrs Depreciation Calculator With Formula Nerd Counter

Depreciation Formula Calculate Depreciation Expense

How To Calculate Depreciation As Per Companies Act 2013 Depreciation Chart As Per Companies Act Youtube

Depreciation Rate Formula Examples How To Calculate

Straight Line Depreciation Formula And Calculator

Depreciation Schedule Formula And Calculator

Depreciation Schedule Template For Straight Line And Declining Balance

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

Depreciation Schedule Formula And Calculator

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

Free Macrs Depreciation Calculator For Excel

Straight Line Depreciation Calculator Double Entry Bookkeeping

Free Depreciation Calculator In Excel Zervant

Depreciation Calculator For Companies Act 2013 Fixed Asset Register Youtube

Depreciation Calculator For Companies Act 2013 Taxaj